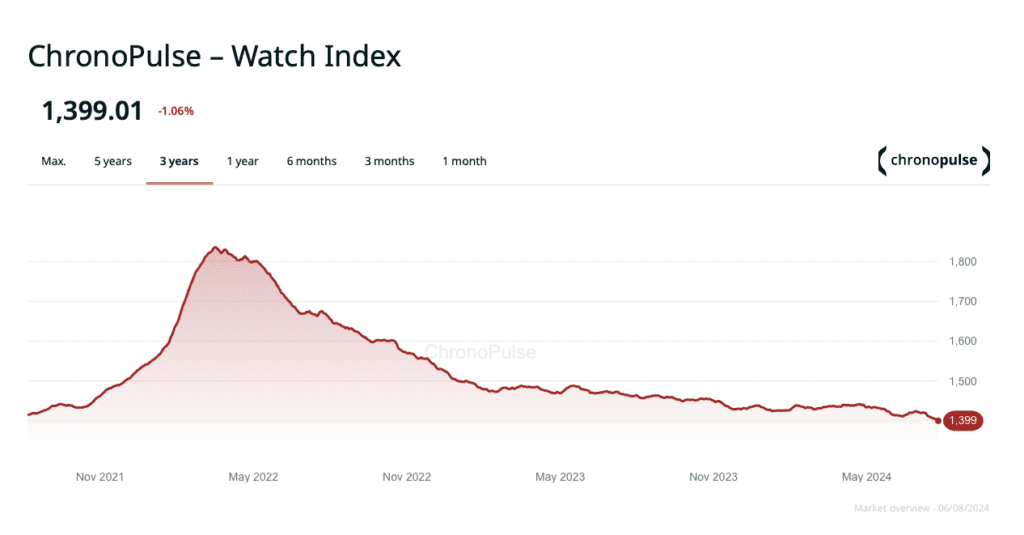

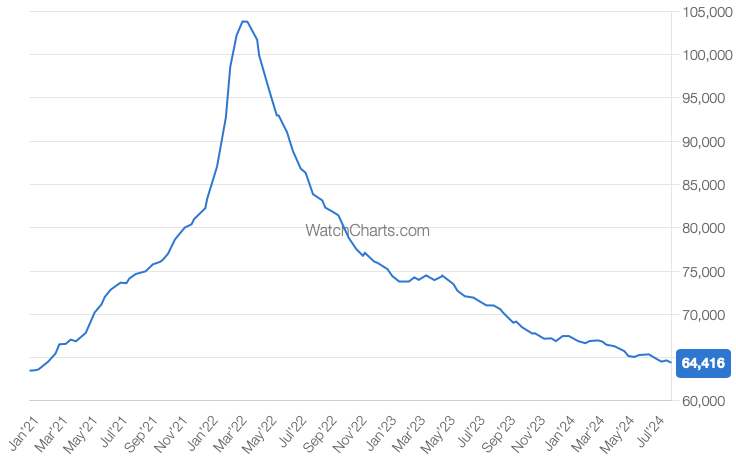

The peak (or bubble, if you will) of pre-owned watch prices can be defined very specifically. In April 2022, during and right after that years’ Watches and Wonders, the price indices of pre-owned luxury watches peaked and reached the highest levels ever. Like other asset classes such as stocks and crypto the euphoria is always followed by a decline, and watches proved to be no exception.

We are almost two years later now, and that decline is still in process. Is it still a correction of an overheated bubble, or are we looking at a more fundamental downturn? I don’t know, but the charts on Watch Market Index (by Watchcharts.com) and Chronopulse (by Chrono24) give a good indication of the state of the market. The overall view is decline, but I searched for 3 watches that currently rise in value.

2 and 3 year index WatchCharts and Chrono24

First I looked at the longer term, and both Watch Charts and Chrono24 show the April 2022 peak very clearly. Chrono24 works with an index and the latest number (1399) indicates a 24% decline compared to the 2022 peak (1820). This is based on an average of all indicated brands and models. The downturn at Watch Charts is even bigger around 40%. If we shorten the timeframe and focus on the developments in the past 12 months the 2022 peak is phased out, leading to a more modest decline. Chrono24 showed an index of 1464 a year ago, compared to 1399 now, a 5% decline in market prices. Watch Charts moved from 71033 to 64406, almost 10%. Putting a more in-depth analysis aside the direction is clear: In the past 12 months pre-owned luxury watches have lost value, on average.

Which brands lose and win?

Of course we first look at Rolex. Despite that fact that new models are still selling above retail the brand took a cut of 6,4% in value over the past 12 months. Collector darlings like Patek Philippe and Audemars Piguet performed even worse, going down 12,3% and 11,4% respectively. Looking further in the list we see that not many brands were able to increase their index value in the past year. In fact, only 10 brands were able to generate a positive index value over the past year including Junghans, Frederique Constant, Glycine, Certina and Hamilton as the top performers. I know, trade in these kind of brands is much more limited which affects the outcome, but the direction is clear. The main players in watch collecting are still tanking.

Three watches that do grow in value

When a brand has a declining index value it does not necessarily mean all the models are going down. Best-known example is probably the Rolex GMT-Master “Pepsi”, which has grown in value 1,4% in the past year according to Watch Charts and even 4,5% on the Chronopulse index. Exceptions make the rule and demand for the Pepsi keeps on growing. Some other examples that might be a good investment now:

1) Jaeger-LeCoultre Reverso Duoface

2) Cartier Santos de Cartier

3) Omega Speedmaster Dark Side of the Moon

The Omega index shows a 4,66% decline on Chronopulse in the past 12 months, but the Speedmaster Dark side of the Moon is one of the brands’ few exceptions. The above shown reference sells for a healthy 8,65% profit compared to last year. Another example that when the hype is over the most iconic and best-known watches are generally a safe bet.

My three suggestions are in no way an advice to purchase or invest, and just an illustration of interesting watches to look at. I invite you to check both the Chronopulse index on Chrono24 and the Watch Charts watch index yourself. It’s both entertaining and educational.