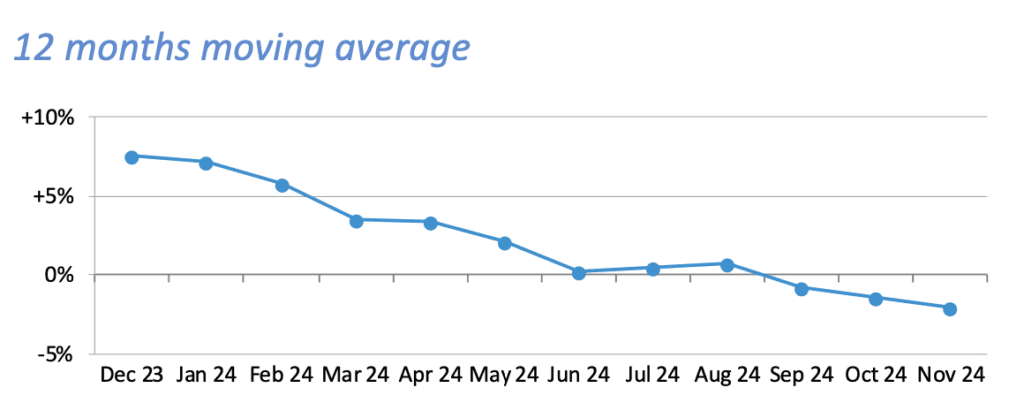

I regularly observe the export numbers of Swiss watches, as compiled monthly by the Swiss Watch Federation. Up until November 2024 a consistent decline is visible with the 12 month moving average slowly declining. I am not a trend analyst, but the current trend shows me a situation where not much growth is to be expected for 2025. What can we expect?

New Watches

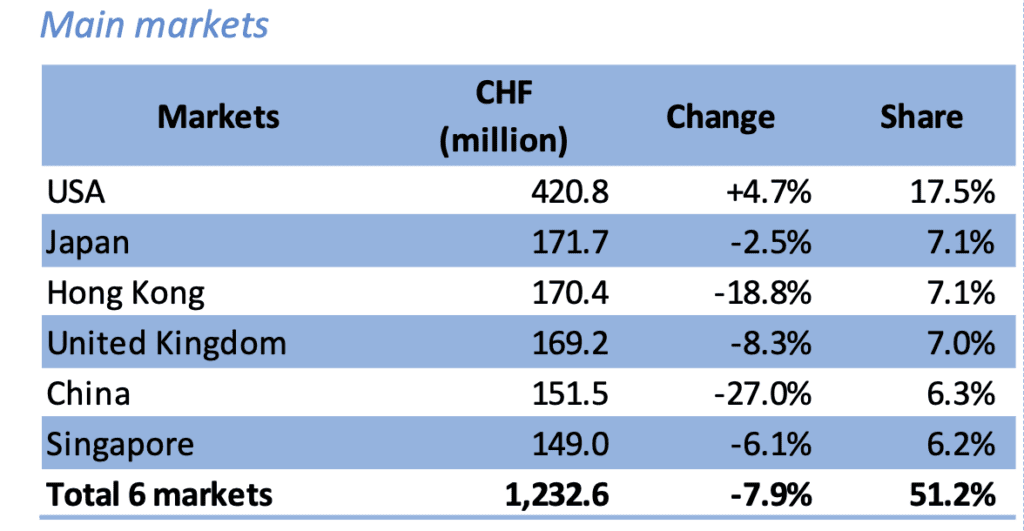

Looking at the main markets in November 2024 (the most recent numbers available) we see an overall decline of 7,9% globally, strongly influenced by the Asian markets. Hong Kong and China show a decline of 18,8% and 27,0% respectively. The economic downturn and declining stock markets indicate that pressure will be on here for a while. The US market shows more strength as well as some specific markets such as Spain (21.7%) and India (59.7%). Nice, but surely not sufficient to break the decline trend that set in in September 2024 any time soon.

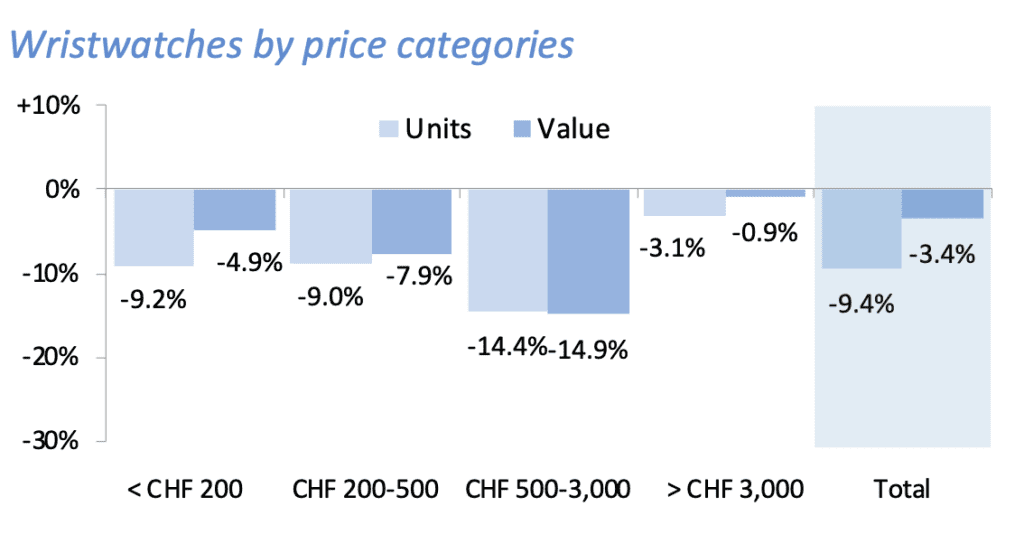

When we look at the price categories we see the biggest hit is taken in the CHF 500/3,000 segment both in numbers sold and in value. The high-end segment, with retail prices above CHF 3,000 is suffering the least, especially in value. Here we probably see the effect of the prices increases widely implemented.

Pre-owned Market

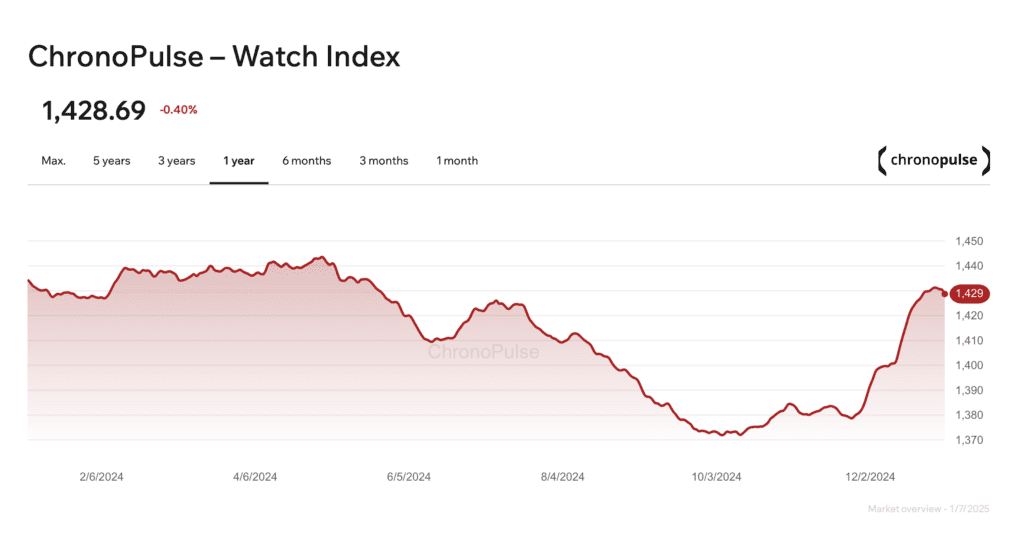

The pre-owned market is more diverse but in general it follows the same movement. Looking at the Chronopulse data, based on actual transactions on Chrono24 we see a rather strong decline in the second part of 2024, followed by a magical rise before the end of the year. It results in an almost flat 2024 (-0,40%). We still haven’t seen the December 2024 export numbers, it will be interesting to see if there is an upside here as well. In the bigger picture it seems like 2024 has been a consolidation year after a strong decline in 2022 and 2023, right after the April 2022 hype peak.

So, a consolidation year in general, measuring all brands in all segments. What if we zoom in on some important brands?

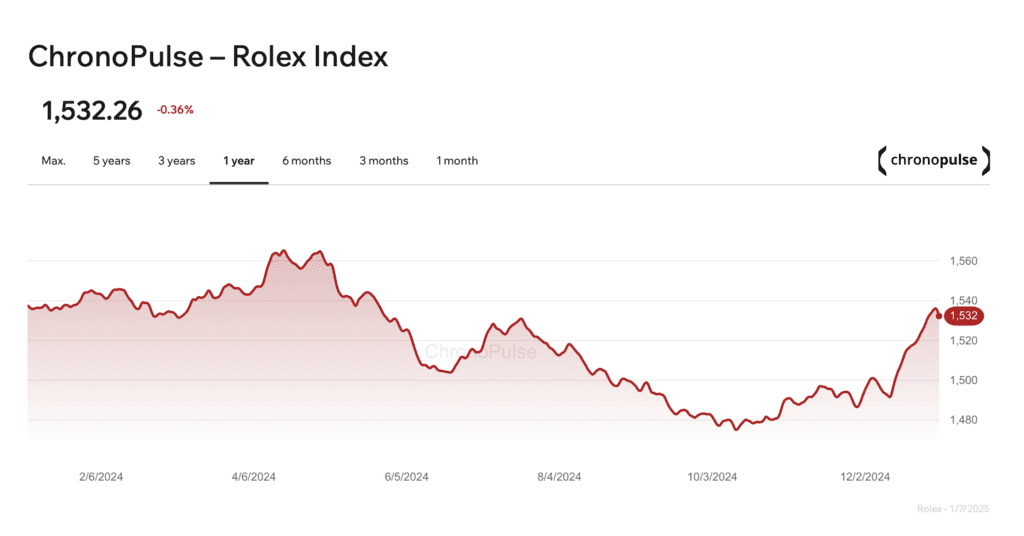

Rolex

Patek Philippe

In one of my previous posts we discussed the decline of Patek. Of course, the brand was one of the most inflated in price at the peak of the hype, concentrated on few references. Therefore the decline is bigger and ended at and average of -2,51% for the year. The hype (and controversy) around the Cubitus’ introduction proves that the appeal is still very strong and new watches are still very difficult to obtain if you’re not an insider.

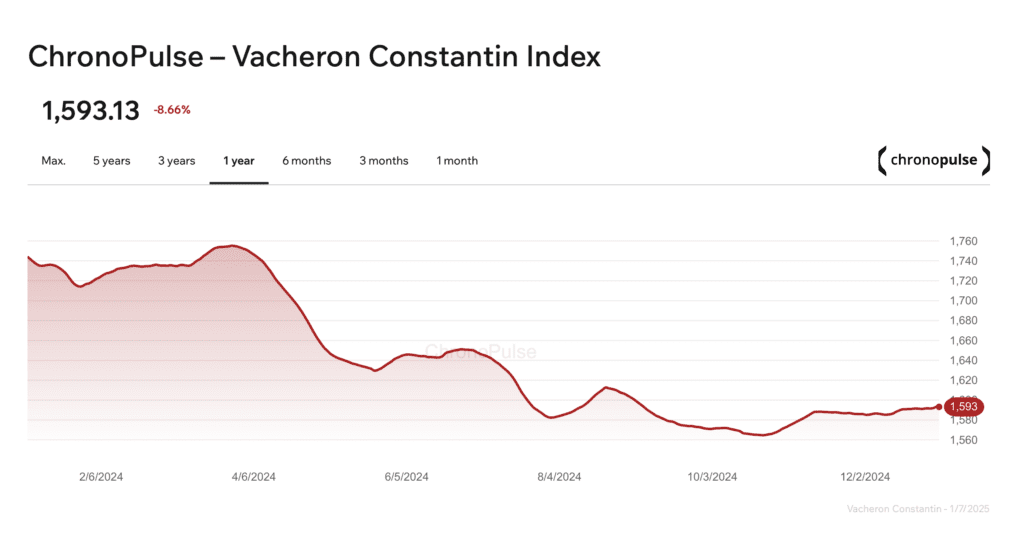

Vacheron Constantin

What will 2025 bring?

After the hype peak in April 2022, the watch market went south and in 2024 the pre-owned market seems to have bottomed. The hype is out of the market and prices are settling in general. The market of new watches shows a trend that is a bit more worrying, and growth is negative.

At the same time many brands follow the yearly tradition of prices increases, which is inevitable if we look at inflation of labour cost, materials etc. Precious medal price increases, especially gold, add an extra factor, following the global gold prices.

So higher prices, decreasing demand and insecure economic forecasts (look at the US unemployment numbers) are not a healthy mix. I would be surprised if growth returns in 2025 and if the consolidation on the pre-owned market will hold.